July 31, 2019

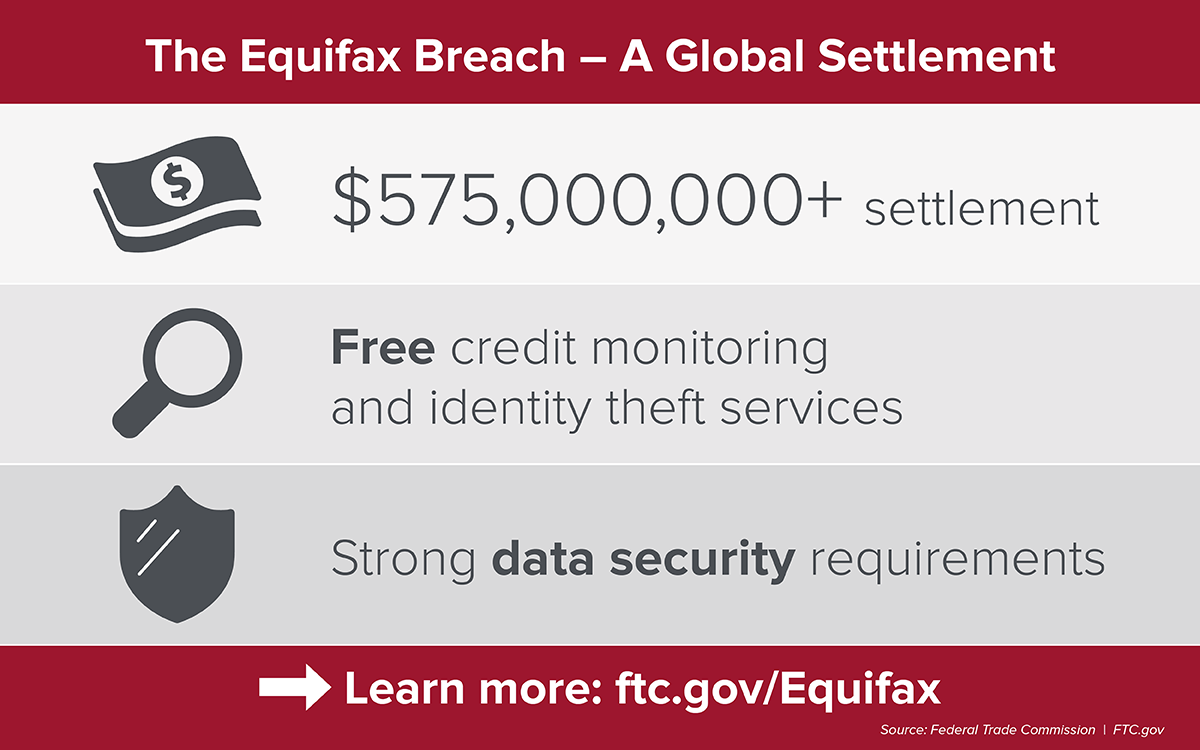

Just last week, the FTC and others reached a settlement with Equifax about its September 2017 data breach that exposed personal information of 147 million people. We’ve told you to go to ftc.gov/Equifax, where you can find out if your information was exposed and learn how to file a claim with the company in charge of the claims process.

The public response to the settlement has been overwhelming, and we’re delighted that millions of people have visited ftc.gov/Equifax and gone on to the settlement website’s claims form.

But there’s a downside to this unexpected number of claims. First, though, the good: all 147 million people can ask for and get free credit monitoring. There’s also the option for people who certify that they already have credit monitoring to claim up to $125 instead. But the pot of money that pays for that part of the settlement is $31 million. A large number of claims for cash instead of credit monitoring means only one thing: each person who takes the money option will wind up only getting a small amount of money. Nowhere near the $125 they could have gotten if there hadn’t been such an enormous number of claims filed.

So, if you haven’t submitted your claim yet, think about opting for the free credit monitoring instead. Frankly, the free credit monitoring is worth a lot more – the market value would be hundreds of dollars a year. And this monitoring service is probably stronger and more helpful than any you may have already, because it monitors your credit report at all three nationwide credit reporting agencies, and it comes with up to $1 million in identity theft insurance and individualized identity restoration services.

For those who have already submitted claims for this cash payment, look for an email from the settlement administrator. They’ll be asking you for the name of the credit monitoring service you already have. Or, if you want to change your mind, you’ll have a chance to switch to the free credit monitoring. You can also email the settlement administrator, JND, at info@EquifaxBreachSettlement.

Please also note that there is still money available under the settlement to reimburse people for what they paid out of their pocket to recover from the breach. Say you had to pay for your own credit freezes after the breach, or you hired someone to help you deal with identity theft. The settlement has a larger pool of money for just those people. If you’re one of them, use your documents to submit your claim.